does doordash report income to irs

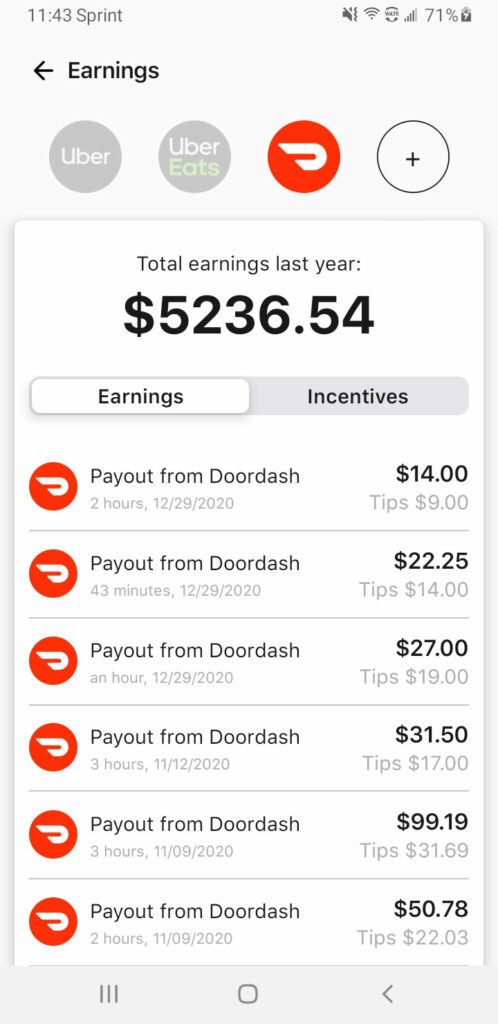

If you delivered for multiple delivery platforms and received multiple 1099 forms you add all that money up and enter the total income on Line 1. Does DoorDash report to IRS.

Prepare For Tax Season With These Restaurant Tax Tips

DoorDash dashers will need a few tax forms to complete their taxes.

. In this way Does DoorDash count as job. DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS. 2 days ago.

If you overpaid at the end of the year you will get some money. DoorDash does not take out withholding tax for you. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

At the end of every quarter add up your income for the quarter and pay at least 25 of that online to the govt. What DoorDash taxes do you have to pay. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

The forms are filed with the US. You do have the obligation to report any income to the IRS regardless of whether a 1099 was sent to you -- assuming you made at least 12550 total as a single taxpayer etc. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly.

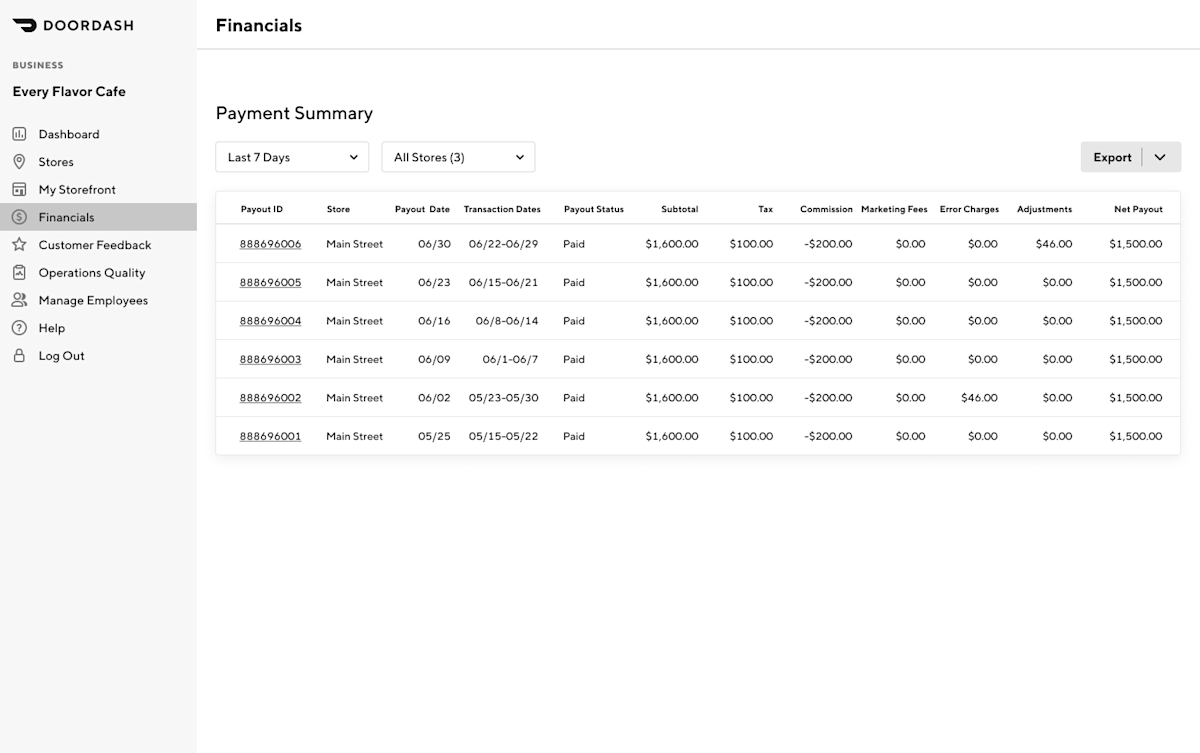

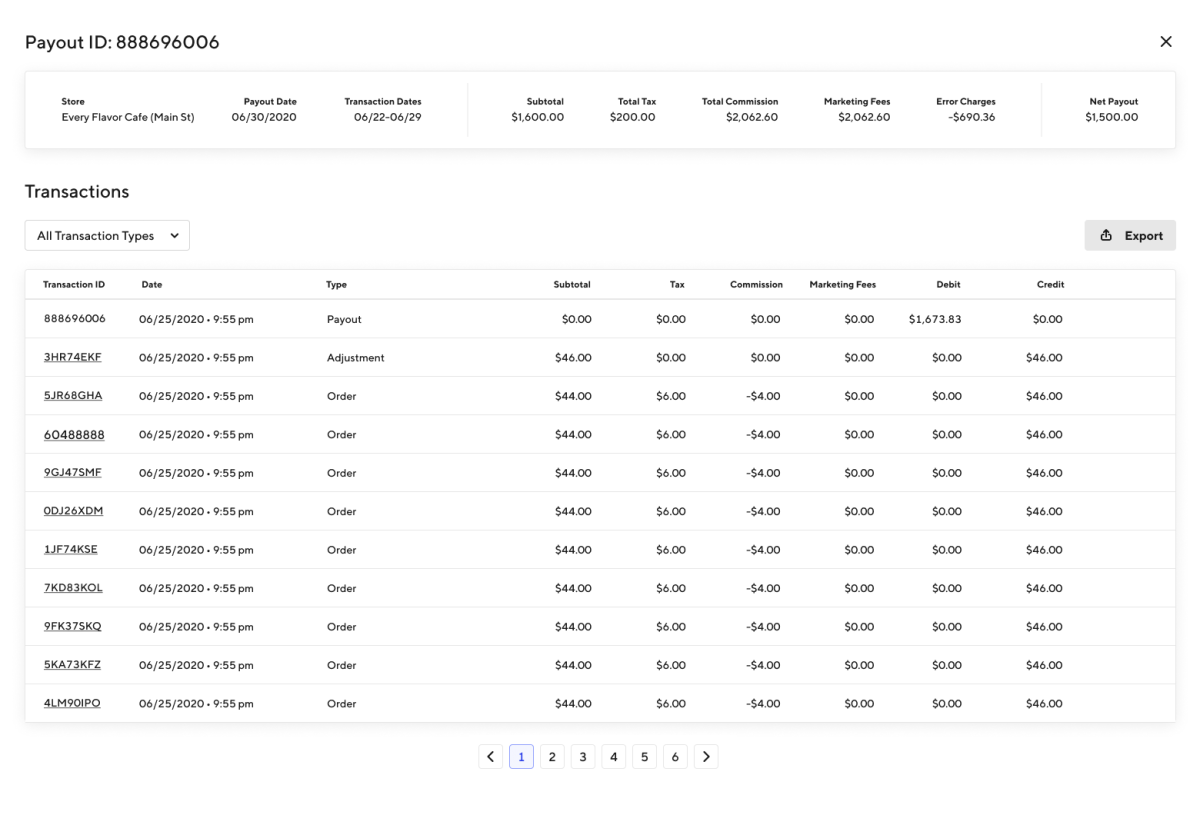

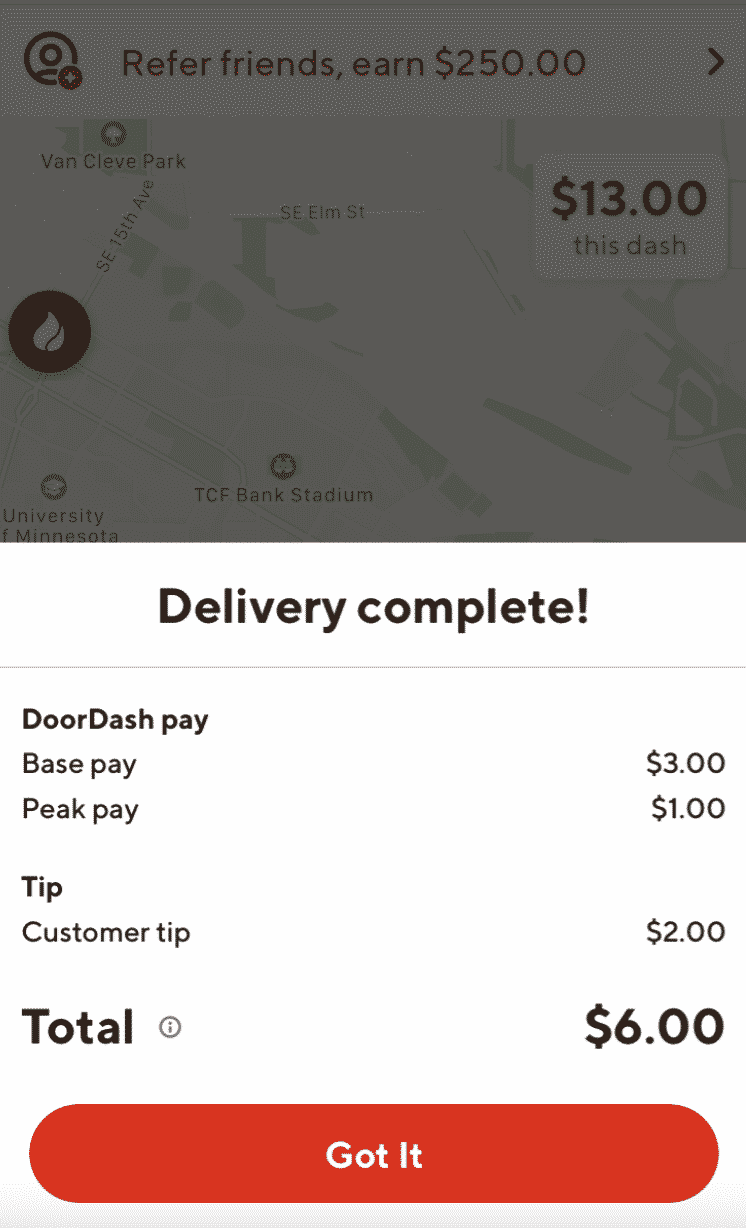

As such it looks a little different. DoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc. January 31 -- Send 1099 form to recipients.

Doordash will send you a 1099-NEC form to report income you made working with the company. Does DoorDash report to IRS. How Do I Apply For Unemployment Benefits With DoorDash.

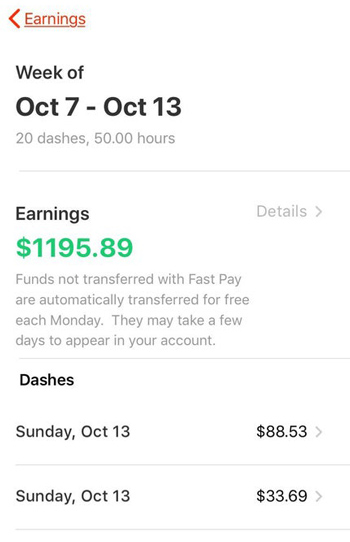

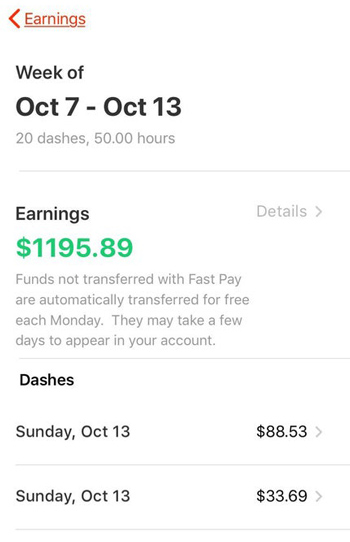

Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes. This is where you enter your earnings from Grubhub Doordash Uber Eats and others. Log into your checking account every pay day and put at least 25 of your dd earnings in savings.

DoorDash uses Stripe to process their payments and tax returns. DoorDash dashers who earned more than 600 in the previous calendar year will receive a 1099-NEC form through their partner Strip. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

However you still need to. But there are some circumstances where the IRS doesnt require you to file at all. A 1099 form differs from a W-2 which is the standard form issued to employees.

You do not get quarterly earnings reports from dd. The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year. You are required to report and pay taxes on any income you receive.

Tough to decipher the exact question youre asking but. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. DoorDash typically manages 1099 delivery drivers.

Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. January 31 -- Send 1099 form to recipients. How does Instacart report wages.

Here is a roundup of the forms required. FICA stands for Federal Income Insurance Contributions Act. March 31 -- E-File 1099-K forms with the IRS via FIRE.

DoorDash does not automatically withhold taxes. Stripe also sends 1099-Ks for other companies or payments but the way theyre set up with DoorDash means DoorDash work will go on a 1099-NEC for DoorDash. You do have the.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Some confuse this with meaning they dont need to report that income on their taxes. The bill though is a lot steeper for independent contractors.

As a Dasher youre an independent contractor. Yes - Cash and non-cash tips are both taxed by the IRS. Once you receive the 1099 form and file the taxes you need to report the exact figure as the overall income to the IRS.

Gross receipts or sales. The 600 threshold is not related to whether you have to pay taxes. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe.

Since youre an independent contractor instead of an employee DoorDash wont withhold any taxable income for you leading to a higher bill from the IRS. DoorDash uses Stripe to process their payments and tax returns. Your cash tips are not included in the information on the 1099-NEC you receive from Doordash.

Here you will add up how much money you received for your delivery work. It sends it out regularly to them but anyone who hasnt yet received it can request it. That said this depends on the state.

They have no obligation to report your earnings of. Federal income taxes apply to Doordash tips unless their total amounts are below 20. February 28 -- Mail 1099-K forms to the IRS.

If your store is on Marketplace Facilitator DoorDash. It might be a side job or a side hustle but in the end it just means. Since you have dropped the income source many states in The United states involve working part-time and gathering jobless benefits.

DoorDash can be used as proof of income. Its only that Doordash isnt required to send you a 1099 form if you made less than 600. The default answer is yes because you asked about reporting.

Does DoorDash provide a 1099. But if filing electronically the deadline is March 31st. Its only that Doordash isnt required to send you a 1099 form if you made less than 600.

If you fit that circumstance reporting is. If you are completing a tax return everything is supposed to be reported. Technically both employees and independent contractors are on the hook for these.

How does DoorDash report to IRS. Answer 1 of 5. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income.

You should report your income immediately if they do not send you a 1099.

Doordash Gave Me 3 500 For Adjustment Pay Will They Take It Away And Realize They Made A Mistake I Only Made 400 For The Week Quora

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash Data Breach 5 Things To Do If You Were Affected

Doordash Driver Canada Everything You Need To Know To Get Started

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

2022 Data How Much Doordash Drivers Actually Make Ridesharing Driver

Doordash 1099 Critical Doordash Tax Information For 2022

Prepare For Tax Season With These Restaurant Tax Tips

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Prepare For Tax Season With These Restaurant Tax Tips

Doordash 1099 Critical Doordash Tax Information For 2022

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Doordash Taxes Does Doordash Take Out Taxes How They Work

Does Doordash Pay For Gas Financial Panther

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance